Financial Literacy Month: Fact: Did You Know?

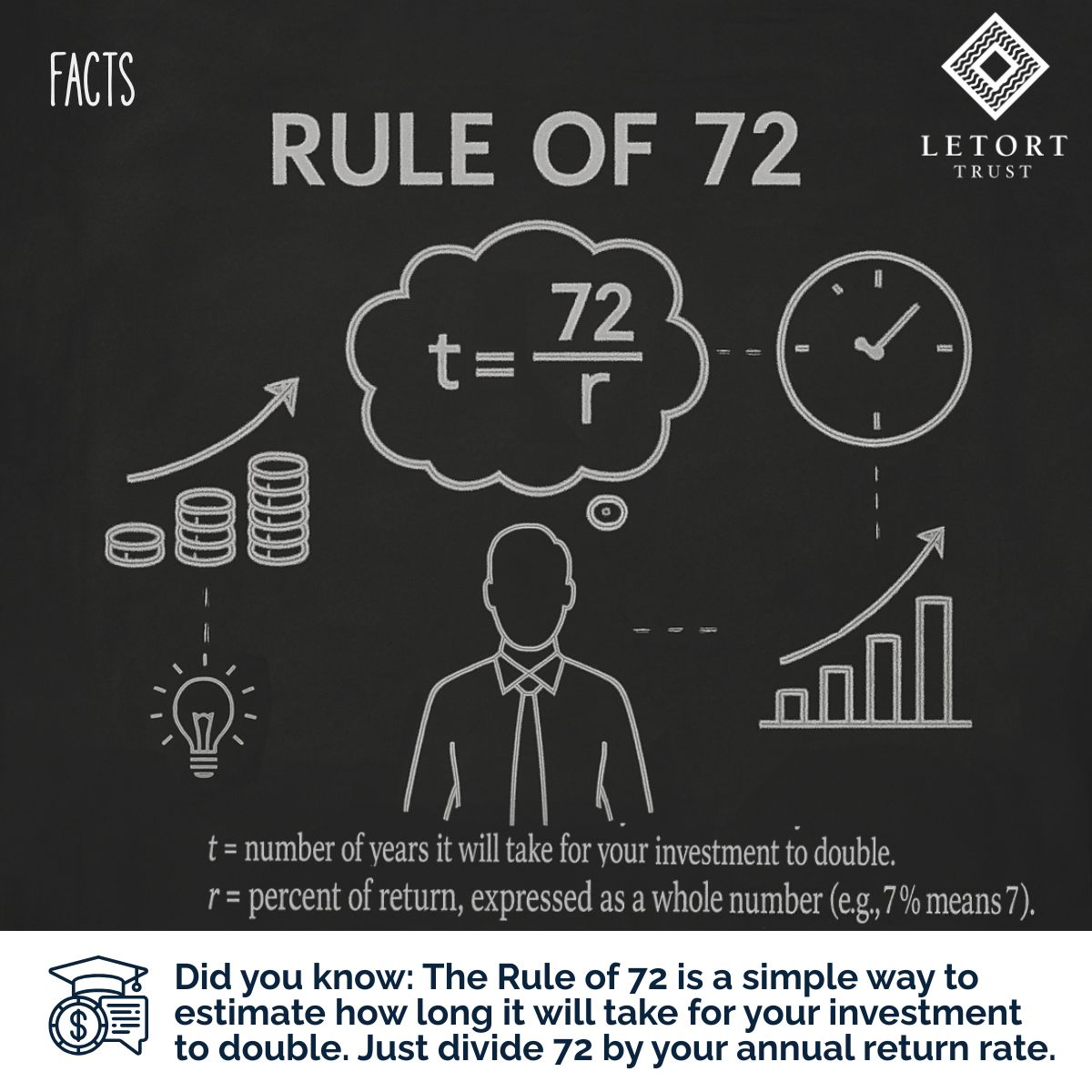

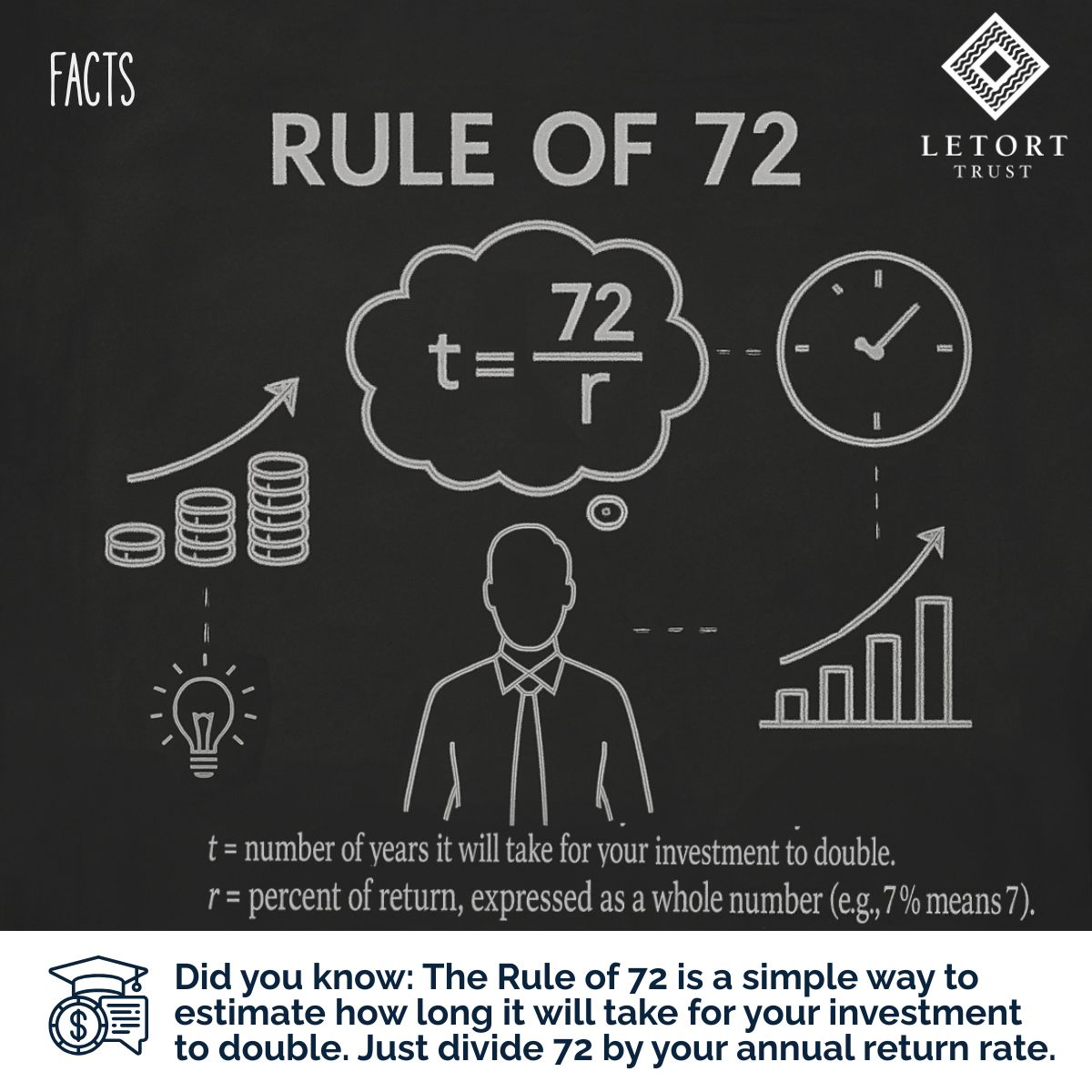

The Rule of 72 is a simple way to estimate how long it will take for your investment to double. Just divide 72 by your annual return

The Rule of 72 is a simple way to estimate how long it will take for your investment to double. Just divide 72 by your annual return

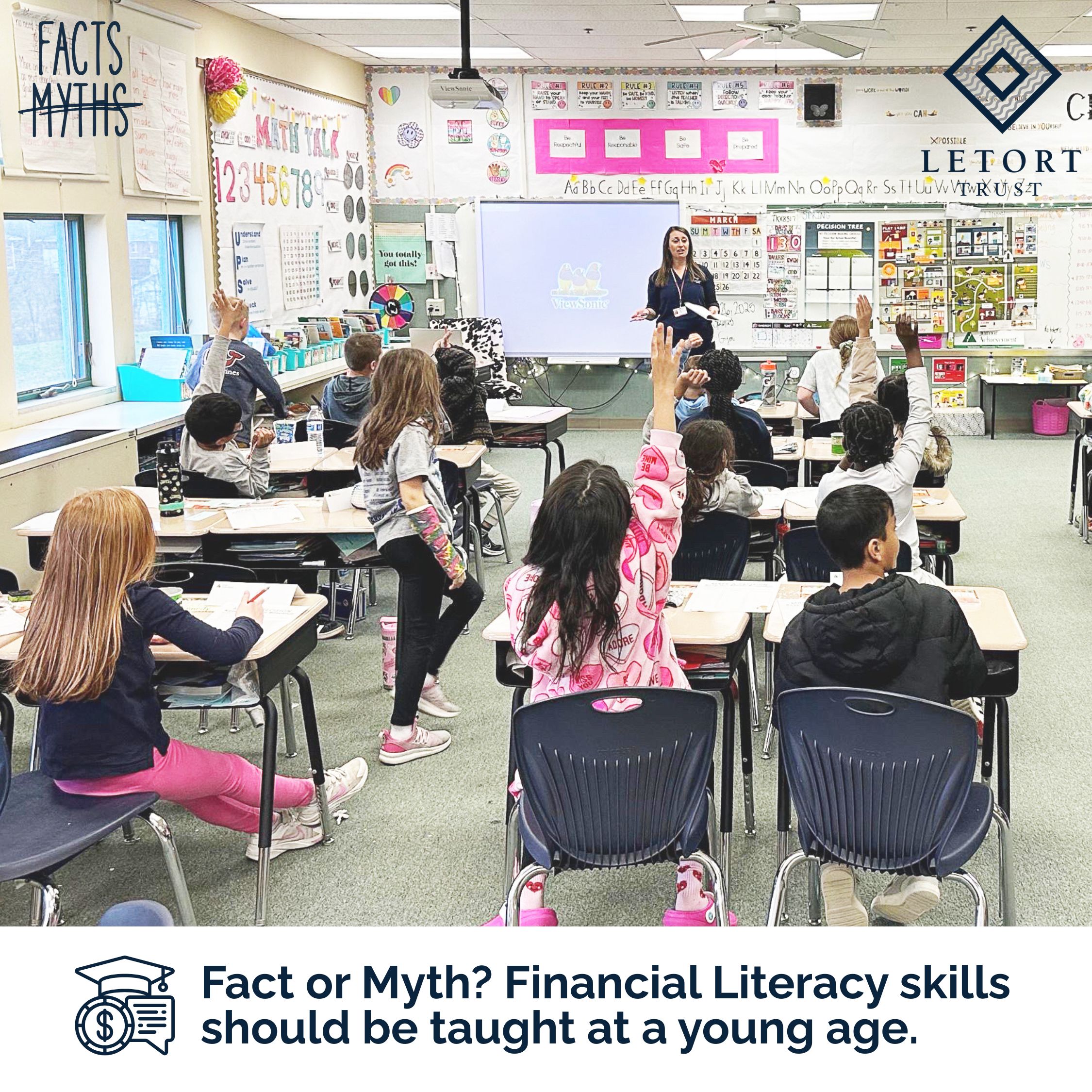

Financial literacy is a lifelong skill that benefits people of all ages, not just adults. Fact! Kids and teens make financial decisions too. From saving

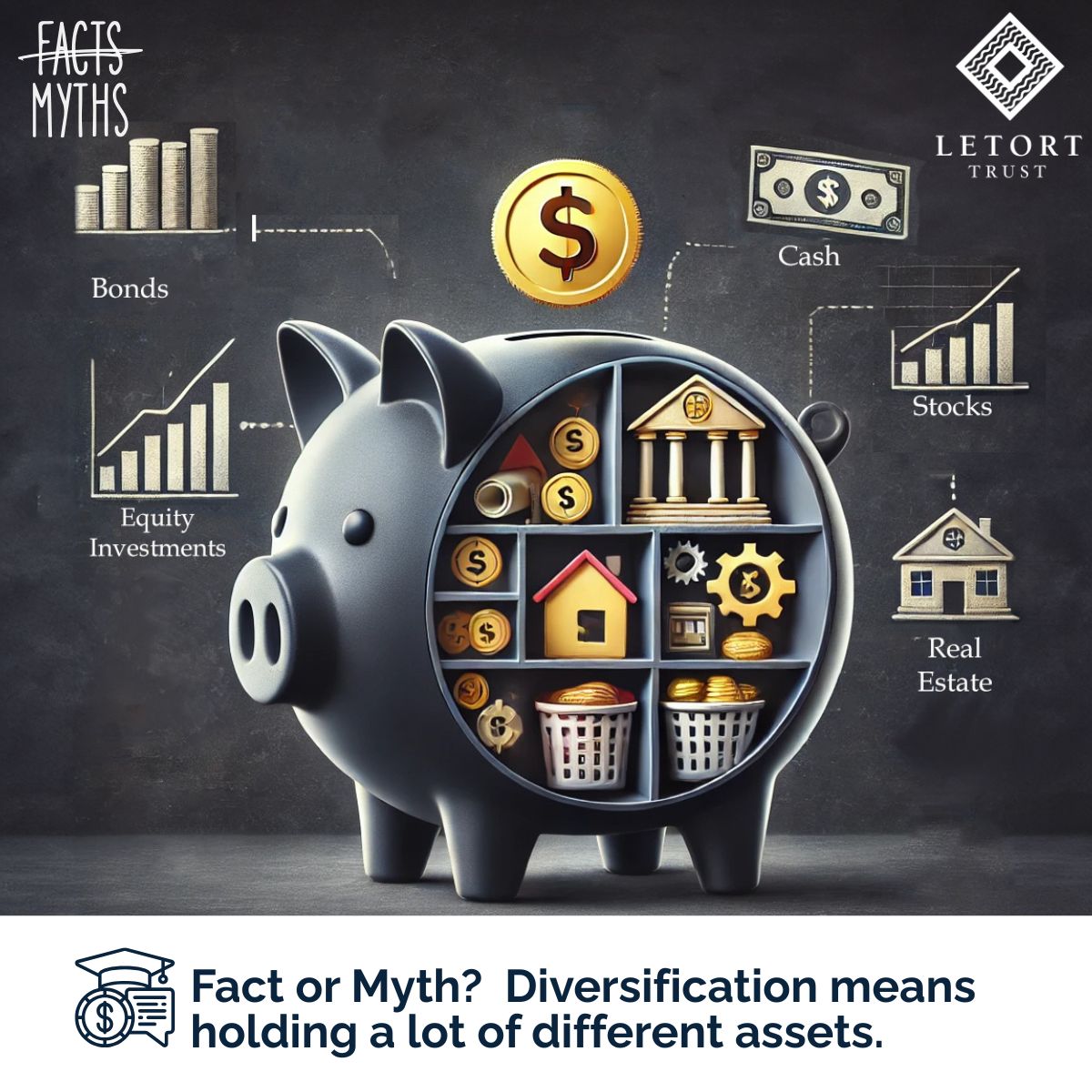

Fact or Myth? Spreading your investments across different accounts or advisors means you’re automatically diversified. Myth! Simply using different platforms or advisors doesn’t guarantee diversification.

The Investopedia Team Feb. 26, 2025 The best option for a windfall of cash might be to invest it if a realistic rate of return

Mechanicsburg, PA (February 14, 2025) – LeTort Trust is excited to announce that Jennifer Sensky has joined our Operations Team as Client Concierge. Jenn plays

Mechanicsburg, Pennsylvania (November 05, 2024) – LeTort Trust, an independent trust company providing Qualified Retirement Plan Management and Family Wealth Management services, is excited to announce

IR-2024-285, Nov. 1, 2024 WASHINGTON — The Internal Revenue Service announced today that the amount individuals can contribute to their 401(k) plans in 2025 has increased to

Harrisburg, PA April 10, 2024- LeTort Trust Foundation, formerly known as the Atgooth Foundation, proudly donated $25,000 to support phase two of the Bethesda Mission