The SECURE 2.0 legislation included in the $1.7 trillion appropriations bill passed late last year builds on changes established by the original Setting Every Community Up for Retirement Enhancement Act (SECURE 1.0) enacted in 2019. SECURE 2.0 includes significant changes to the rules that apply to required minimum distributions from IRAs and employer retirement plans. Here’s what you need to know.

What Are Required Minimum Distributions (RMDs)?

Required minimum distributions, sometimes referred to as RMDs or minimum required distributions, are amounts that the federal government requires you to withdraw annually from traditional IRAs and employer retirement plans after you reach a certain age, or in some cases, retire. You can withdraw more than the minimum amount from your IRA or plan in any year, but if you withdraw less than the required minimum, you will be subject to a federal tax penalty.

These lifetime distribution rules apply to traditional IRAs, Simplified Employee Pension (SEP) IRAs and Savings Incentive Match Plan for Employees (SIMPLE) IRAs, as well as qualified pension plans, qualified stock bonus plans, and qualified profit-sharing plans, including 401(k) plans. Section 457(b) plans and Section 403(b) plans are also generally subject to these rules. (If you are uncertain whether the RMD rules apply to your employer plan, you should consult your plan administrator or a tax professional.)

Here is a brief overview of the top five ways that the new legislation changes the RMD rules.

1. Applicable Age for RMDs Increased

Prior to passage of the SECURE 1.0 legislation in 2019, RMDs were generally required to start after reaching age 70½. The 2019 legislation changed the required starting age to 72 for those who had not yet reached age 70½ before January 1, 2020.

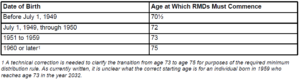

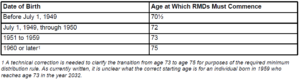

SECURE 2.0 raises the trigger age for required minimum distributions to age 73 for those who reach age 72 after 2022. It increases the age again, to age 75, starting in 2033. So, here’s when you have to start taking RMDs based on your date of birth:

Your first required minimum distribution is for the year that you reach the age specified in the chart, and generally must be taken by April 1 of the year following the year that you reached that age. Subsequent required distributions must be taken by the end of each calendar year (so if you wait until April 1 of the year after you attain your required beginning age, you’ll have to take two required distributions during that calendar year). If you continue working past your required beginning age, you may delay RMDs from your current employer’s retirement plan until after you retire.

2. RMD Penalty Tax Decreased

The penalty for failing to take a required minimum distribution is steep — historically, a 50% excise tax on the amount by which you fell short of the required distribution amount.

SECURE 2.0 reduces the RMD tax penalty to 25% of the shortfall, effective this year (still steep, but better than 50%).

Also effective this year, the Act establishes a two-year period to correct a failure to take a timely RMD distribution, with a resulting reduction in the tax penalty to 10%. Basically, if you self-correct the error by withdrawing the required funds and filing a return reflecting the tax during that two-year period, you can qualify for the lower penalty tax rate.

3. Lifetime Required Minimum Distributions from Roth Employer Accounts Eliminated

Roth IRAs have never been subject to lifetime Required Minimum Distributions. That is, a Roth IRA owner does not have to take RMDs from the Roth IRA while he or she is alive. (Distributions to beneficiaries are required after the Roth IRA owner’s death, however.)

The same has not been true for Roth employer plan accounts, including Roth 401(k) and Roth 403(b) accounts. Plan participants have been required to take minimum distributions from these accounts upon reaching their RMD age or avoid the requirement by rolling over the funds in the Roth employer plan account to a Roth IRA.

Beginning in 2024, the SECURE 2.0 legislation eliminates the lifetime RMD requirements for all Roth employer plan account participants, even those participants who had already commenced lifetime RMDs. (Any lifetime RMD from a Roth employer account attributable to 2023, but payable in 2024, is still required.)

4. Additional Option for Spouse Beneficiaries of Employer Plans

The SECURE 2.0 legislation provides that, beginning in 2024, when a participant has designated his or her spouse as the sole beneficiary of an employer plan, a special option is available if the participant dies before required minimum distributions have commenced.

This provision will permit a surviving spouse to elect to be treated as the employee, similar to the already existing provision that allows a surviving spouse who is the sole designated beneficiary of an inherited IRA to elect to be treated as the IRA owner. This will generally allow a surviving spouse the option to delay the start of required minimum distributions until the deceased employee would have reached the appropriate RMD age, or until the surviving spouse reaches the appropriate RMD age, whichever is more beneficial. This will also generally allow the surviving spouse to utilize a more favorable RMD life expectancy table to calculate distribution amounts.

5. New Flexibility Regarding Annuity Options

Starting in 2023, the SECURE 2.0 legislation makes specific changes to the required minimum distribution rules that allow for some additional flexibility for annuities held within qualified employer retirement plans and IRAs. Allowable options may include:

- Annuity payments that increase by a constant percentage, provided certain requirements are met

- Lump-sum payment options that shorten the annuity payment period

- Acceleration of annuity payments payable over the ensuing 12 months

- Payments in the nature of dividends

- A final payment upon death that does not exceed premiums paid less total distributions made

These are just a few of the many provisions in the SECURE 2.0 legislation. The rules regarding required minimum distributions are complicated. While the changes described here provide significant benefit to individuals, the rules remain difficult to navigate, and you should consult a tax professional to discuss your individual situation.

It is important to understand that purchasing an annuity in an IRA or an employer-sponsored retirement plan provides no additional tax benefits beyond those available through the tax-deferred retirement plan. Qualified annuities are typically purchased with pre-tax money, so withdrawals are fully taxable as ordinary income, and withdrawals prior to age 59½ may be subject to a 10% federal tax penalty.

IMPORTANT DISCLOSURES

LeTort Trust does not provide tax or legal advice. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax

professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources

believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2023

Tya provides support to the Personal Trust department, focusing on essential functions such as client bill pay, distributions, and compiling documentation for new accounts. Tya has an extensive background in the financial services and banking industry, most recently working as a Financial Service Representative for Ameri Choice Federal Credit Union.

Tya provides support to the Personal Trust department, focusing on essential functions such as client bill pay, distributions, and compiling documentation for new accounts. Tya has an extensive background in the financial services and banking industry, most recently working as a Financial Service Representative for Ameri Choice Federal Credit Union.