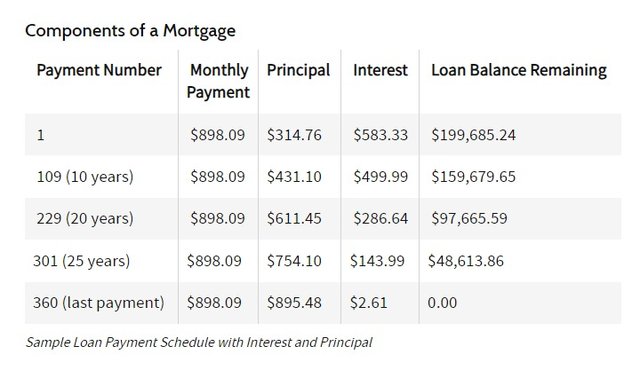

A larger portion of the fixed monthly payment goes toward paying interest during the first 10 years, but the percentage of the monthly payment that goes toward interest versus principal reverses as time goes on. More than $611 went toward principal while $286.64 went toward interest after 20 years. All but $2.61 of the last monthly payment went toward paying the principal balance.

The portion of the mortgage loan payment that’s applied to principal and interest changes over the years because the loan balance is higher in the early years and smaller in the later years. You’re paying interest on more of a balance in the early years. Less interest is owed as the monthly payments eventually reduce the outstanding loan.

How Much Interest Will You Save?

Some homeowners choose to pay off their mortgages early, and the benefits can vary depending on your financial circumstances. Retirees might want to reduce or eliminate their mortgage debts because they’re no longer earning employment income.

Let’s assume that a borrower has received an inheritance of $120,000. There are 10 years left on their mortgage. The original mortgage was $200,000 at a fixed interest rate over 30 years. This table shows what it would cost to pay off the loan 10 years early and how much interest would be saved based on three loan rates: 3.50%, 4.50%, or 5.50%.

The higher the interest rate, the larger the amount remaining on the loan will be with 10 years left on the mortgage.

Save Interest by Paying Off the Loan

The total interest cost for the 30-year loan would be $123,312 at the 3.50% interest rate. The borrower would save $20,270 by paying it off 10 years early.

Saving more than $20,000 in interest is significant, but the interest amount saved represents only 17% of the total interest cost for a 30-year loan: $103,042 in interest has already been paid in the loan’s first 20 years ($123,312 – $20,270), which accounts for 83% of the total interest over the life of the loan.

How Investing Affects Your Finances

It might be worth considering whether some or all of your money might be better off invested in the financial markets. The rate of return earned from investing might exceed the interest you’d pay on the mortgage over the final 10 years of the loan.

The “opportunity cost,” the foregone interest that could be earned in the market, should be considered. But many factors go into evaluating an investment, including the expected return and the risk associated with the investment. This table shows how much could be earned on $100,000 if the money was invested for 10 years based on four average rates of return: 2%, 5%, 7%, and 10%.

These investment gains were compounded. Interest was earned on the interest and no money was withdrawn during the 10-year period.

Investment Gains Vs. Loan Interest Saved

A homeowner would earn $22,019 based on an average rate of return of 2% if they invested $100,000 rather than use the money to pay down their mortgage in 10 years. There would be no material difference between investing the money versus paying off the 3.5% mortgage based on the $20,270 saved in interest from the earlier loan table.

But the homeowner would earn $62,889 if the average rate of return was 5% for the 10 years. This is more money than the interest saved in all three of the earlier loan scenarios whether the loan rate was 3.50% ($20,270), 4.50% ($28,411), or 5.50% ($37,618).

The borrower would earn more than double the interest saved from paying the loan off early, even with using the 5.50% loan rate, with a 10-year rate of return of 7% or 10%.

Repaying their mortgage rather than investing the money not only saves the borrower the interest they would have paid on the mortgage, but it also frees up money that otherwise would have gone to monthly repayments. This money could also be invested with the same rate of return.

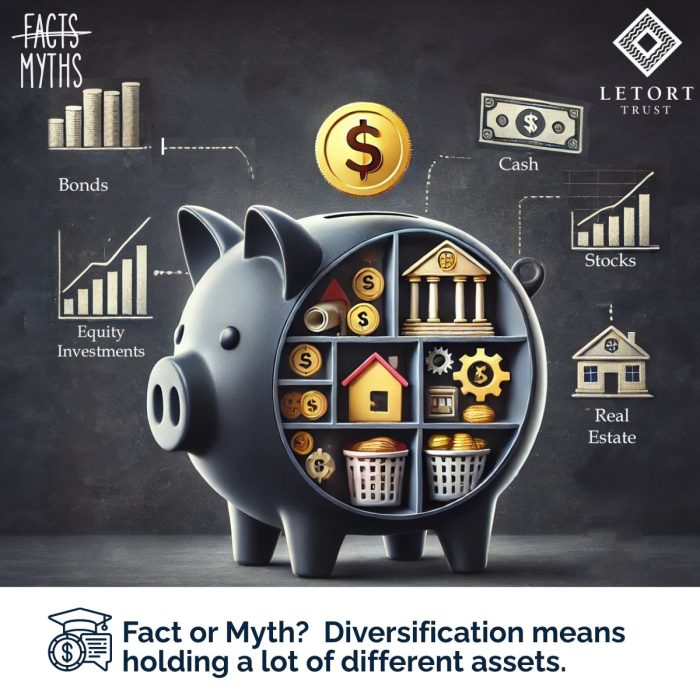

Different Investments Come With Different Risks

Each type of investment comes with its own risk. U.S. Treasury bonds would be considered low-risk investments because they’re guaranteed by the U.S. government if they’re held until their expiration date or maturity. But equities or stock investments have a higher risk of price fluctuations, called volatility, and this can lead to losses.

There’s a risk that some or all your money could be lost if you decide to invest your money in the market instead of paying off your mortgage 10 years early. You would still have to make 10 years of loan payments as a result if the investment loses money.

The stock market can provide sizable returns, but there’s also a risk of sizable losses. Just as taking on more risk can magnify investment gains, it can also lead to more losses so the market risk is a double-edged sword.

A 10% investment gain isn’t an easy goal to achieve, particularly after factoring in fees, taxes, and inflation. Investors should have realistic expectations as to what they can earn in the market.

What the Experts Have to Say

Advisor Insight

Mark Struthers, CFA, CFP

Sona Financial, LLC, Minneapolis, MN

A lot depends on the nature of the mortgage and your other assets. If it’s expensive debt (that is, with a high interest rate) and you already have some liquid assets like an emergency fund, then pay it off. If it’s cheap debt (a low interest rate) and you have a good history of staying within a budget, then maintaining the mortgage and investing might be an option.

Some people’s instinct is to get all debt off their plate, but you want to make sure you always have ready funds on hand to ride out a financial storm. So the best course is usually somewhere in between: If you need some liquidity or cash, then pay off a large chunk of the debt, and keep the rest for emergencies and investments. Just make sure you take an honest look at what you’ll spend and your risks.

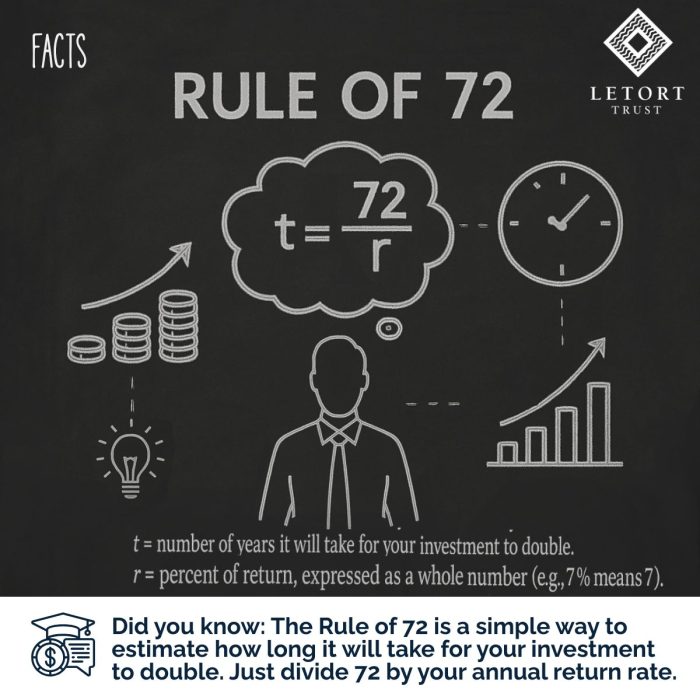

What Is Compounding Interest?

Interest “compounds” when it earns interest. Say you invest $100. That money earns you $5 in interest over a period of time. You’ll be paid interest on $105 if you leave that investment untouched because the interest is compounded. Interest earned on interest can magnify investment gains. This should be compared to how much interest you’ll save if you pay off your mortgage.

How Does the Tax Deduction for Mortgage Interest Work?

The interest you pay on a mortgage loan of up to $750,000 is tax deductible on your federal return subject to numerous rules. The limit drops to $375,000 if you’re married and you file a separate tax return.

The loan proceeds must be used to buy or build your main home or a second home, and you must itemize in order to claim this tax deduction. Itemizing isn’t always in a taxpayer’s best interest because they must forego claiming the standard deduction if they itemize. The standard deduction for their filing status can be more money coming off their taxable income than all their itemized deductions combined.

What Are Some Options Other Than Paying Off My Mortgage or Investing?

You might want to establish the security of an emergency fund to hedge against an ailing economy and to pay your mortgage should you experience financial distress. You might want to save for retirement instead, although this involves investing, too, such as in an IRA or 401(k). You could pay off credit card debt that carries a higher interest rate than your mortgage, particularly if your credit card balances are of a significant amount.

The Bottom Line

It’s important to consider the interest rate, the remaining balance, and how much interest will be saved before you decide to pay off a mortgage loan early. Borrowers can use a mortgage loan calculator to analyze the amortization schedule for their loans.

Another important thing to keep in mind is that mortgage interest is tax deductible for many homeowners. Interest paid reduces your taxable income at the end of the year.

Consult a financial planner and a tax advisor before deciding whether to pay off your mortgage early or invest that money. A professional can help you analyze your own personal situation and goals.

Mechanicsburg, Pennsylvania (November 05, 2024) – LeTort Trust, an independent trust company providing Qualified Retirement Plan Management and Family Wealth Management services, is excited to announce the promotion of Patricia Lauchle to Chief Financial Officer (CFO), effective November 1, 2024.

Mechanicsburg, Pennsylvania (November 05, 2024) – LeTort Trust, an independent trust company providing Qualified Retirement Plan Management and Family Wealth Management services, is excited to announce the promotion of Patricia Lauchle to Chief Financial Officer (CFO), effective November 1, 2024. As part of this contribution, LeTort Trust presented a check to the Bethesda Mission, symbolizing the foundation’s ongoing support for the mission’s initiatives. Accepting on behalf of the Mission was Nashon Walker, along with Cindy Mallow, Director of Development and Andre Cooper, Basketball Coach and Community Center Director. Andre shared, “That this is a huge blessing. Support from organizations like LeTort Trust, help us to facilitate our Seven C’s objectives, while expanding services to the youth and their families at the same time.”

As part of this contribution, LeTort Trust presented a check to the Bethesda Mission, symbolizing the foundation’s ongoing support for the mission’s initiatives. Accepting on behalf of the Mission was Nashon Walker, along with Cindy Mallow, Director of Development and Andre Cooper, Basketball Coach and Community Center Director. Andre shared, “That this is a huge blessing. Support from organizations like LeTort Trust, help us to facilitate our Seven C’s objectives, while expanding services to the youth and their families at the same time.”